Sales revenue at the world's largest parts suppliers bounced back significantly from 2020, even surpassing 2019 results in many cases. But beneath those numbers, suppliers are feeling the pinch.

On the surface, 2021 appeared to be a strong bounce-back year for the biggest auto suppliers.

Of the 100 parts and material companies on this year's edition of the Automotive News top suppliers ranking, 84 reported year-over-year revenue gains from 2020, when pandemic-related work stoppages wreaked havoc on the industry.

The 10 suppliers that topped the list brought in a combined $321.5 billion in revenue for the year — a 10 percent jump from 2020 and even a 2.2 percent increase from 2019.

But dig beyond those surface-level revenue numbers, and it becomes clear that suppliers are still bearing the brunt of increased material costs and supply chain shortages since at least last year, even as sales grew.

"If I didn't know what was happening with automakers, I would say that the suppliers are doing quite OK right now," said Mark Wakefield, a managing director at AlixPartners. "But knowing how well the automakers are doing suggests that suppliers are getting squeezed."

Wakefield: “Less able to absorb”

Wakefield: “Less able to absorb”

Indeed, 2021 was a banner year for automakers' bottom lines, as low inventories and high consumer demand pushed profit margins into the stratosphere. Toyota Motor Corp. smashed its fiscal-year operating profit record, making $24.61 billion in its most recent fiscal year. Automotive News Europe reported in March that operating profits before interest and taxes at the largest American, European and South Korean vehicle manufacturers doubled to $115.2 billion in 2021.

TOP 10 GLOBAL SUPPLIERS

TOP 10 GLOBAL SUPPLIERS

As ranked by 2021 original-equipment parts sales to automakers worldwide (sales in billions)

Supplier (2020 Rank) Sales

1 Robert Bosch -1 $49.14†

2 Denso Corp. -2 $43.57†*

3 ZF Friedrichshafen -3 $39.30

4 Magna International -4 $36.20†

5 Aisin Corp. -5 $33.48†

6 Hyundai Mobis -7 $29.07

7 Forvia** ó $25.88†

8 Continental -6 $24.20†

9 BASF -13 $21.35*

10 Lear Corp. -9 $19.26†

†Fiscal year

*Estimate

**Forvia is the new combined entity for Faurecia and Hella.

Source: Automotive News Research & Data Center

Indeed, 2021 was a banner year for automakers' bottom lines, as low inventories and high consumer demand pushed profit margins into the stratosphere. Toyota Motor Corp. smashed its fiscal-year operating profit record, making $24.61 billion in its most recent fiscal year. Automotive News Europe reported in March that operating profits before interest and taxes at the largest American, European and South Korean vehicle manufacturers doubled to $115.2 billion in 2021.

While automakers have used those profits to reduce debt by $103 billion between 2020 and 2021, suppliers' debt was reduced by only about $2 billion, remaining near record levels, according to AlixPartners.

Wakefield said the profit dynamics between automakers and suppliers have been turned upside down over the past two years amid an unprecedented barrage of supply chain issues.

Margins on suppliers' earnings before interest, taxes, depreciation and amortization had typically stood between 11 and 12 percent before 2019, while automakers' clocked in at around 10 percent, according to Wakefield. But that profit relationship has reversed. In 2021, automakers were at 13 percent EBITDA margins, while suppliers were "just clawing their way" back up to 11 percent, he said.

‘Extra costs'

"Automakers have pricing power," he said. "They've increased prices almost three times more than they've seen increases in their costs, in aggregate.

"Meanwhile, you have suppliers who have not had price increases that even match their cost increases."

In addition, automotive manufacturing has become much less efficient over the past couple of years. According to AlixPartners, it takes about 263 workers to produce a component to supply 1,000 vehicles, up from about 200 in the third quarter of 2020. It takes automakers about 127 workers to build 1,000 vehicles, up from 89.

"There are now lots of extra costs on each of those vehicles," Wakefield said. "Automakers have been able to raise prices, but suppliers have had a difficult time raising prices and are less able to absorb those costs."

That's in large part because of contracts that can lock in costs for extended periods and can be difficult to adjust.

But suppliers are trying anyway.

‘Tough' talks

Paul Thomas, executive vice president of mobility solutions at Robert Bosch, told reporters during a June media event that the German supplier giant is approaching all of its customers to increase its pricing "aligned with the cost increases" it is experiencing in the market. He said Bosch and automakers have had "healthy exchanges" and have discussed localizing materials, finding cheaper alternatives or trying to "internalize" the supply chain as much as possible.

"The conversations are robust," he said. "But the reality is costs are going up, and we have to find a way to make both parties whole."

Robert Bosch retained its No. 1 position on the latest edition of the top suppliers list, with sales of $49.14 billion to automakers worldwide in 2021.

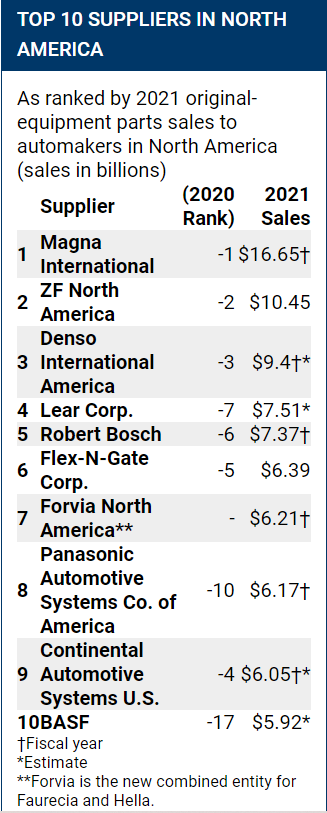

TOP 10 SUPPLIERS IN NORTH AMERICA

As ranked by 2021 original-equipment parts sales to automakers in North America (sales in billions)

Supplier (2020 Rank) 2021 Sales

1 Magna International -1 $16.65†

2 ZF North America -2 $10.45

3 Denso International America -3 $9.4†*

4 Lear Corp. -7 $7.51*

5 Robert Bosch -6 $7.37†

6 Flex-N-Gate Corp. -5 $6.39

7 Forvia North America** - $6.21†

8 Panasonic Automotive Systems Co. of America -10 $6.17†

9 Continental Automotive Systems U.S. -4 $6.05†*

10 BASF -17 $5.92*

†Fiscal year

*Estimate

**Forvia is the new combined entity for Faurecia and Hella.

Source: Automotive News Research & Data Center

Likewise, Canadian supplier Magna International Inc. has been talking with automakers about ways to strike a better balance financially. Magna ranked No. 4 on this year's list, with sales of $36.2 billion to automakers worldwide.

"We continue our discussions with customers at various levels almost on a daily basis," Magna CEO Swamy Kotagiri said during a call with analysts in April.

He said talks between Magna, the largest North American auto supplier, and automakers have been "open and transparent" but sometimes "tough."

"Going forward, we will try to reflect the new economics in our primary markets in North America and Europe," Kotagiri said. "Inflation has been stable and modest for a long time, as an example, but now it's high. ... We are looking at different arrangements going forward to see how we can recover the increased costs."

Despite the many challenges suppliers are facing, mergers, acquisitions and other deals continued at a steady pace as companies looked to prepare for a boom in electric vehicle production and continued advancements in driver-assistance technologies.

Perhaps the most high-profile was Faurecia's acquisition of a controlling stake in Hella, which was announced in late 2021 and closed in 2022. Faurecia ranked No. 8 on the 2021 edition of the Automotive News top suppliers list, while Hella ranked No. 41.

The combined company is now known as Forvia and made its debut on the 2022 list at No. 7, with sales of $25.88 billion to automakers in 2021.

Other newcomers to the list include drivetrain supplier Vitesco Technologies, a former unit of German supplier Continental, at No. 26, and Freudenberg Group at No. 47.

The five largest suppliers in the world were unchanged from 2020. Bosch ranked first, followed by Denso Corp. ($43.57 billion in global sales to automakers), ZF Friedrichshafen ($39.3 billion), Magna and Aisin Corp. ($33.48 billion).

Continental, No. 6 on the 2020 list, fell to No. 8 on this year's edition following the spinoff of Vitesco Technologies. It sold $24.2 billion in parts to automakers in 2021.

German supplier BASF entered the top 10 after finishing No. 13 in 2020, having sold $21.35 billion to automakers in 2021. Hyundai Mobis, meanwhile, rose from No. 7 last year to No. 6 this year.

U.S. supplier Lear Corp. finished No. 10, down from No. 9 last year, while French supplier Valeo fell out of the top 10.

‘Remain optimistic'

When pressed on the state of the industry, many suppliers signal optimism that they will persevere through today's challenges and emerge as major players in the EV era.

Bosch announced in June that it will invest $420 million in its North American manufacturing to retool its component plants and gear up for electrification. Bosch executives said they were pressing ahead to invest, refusing to take their eyes off potential long-term gains, even while handling the more immediate headaches of the last two years.

"Are there challenges ahead? Surely. There are a lot of them," Bosch North America President Mike Mansuetti said. "But despite these challenges, we remain optimistic about our prospects for Bosch in North America, and we continue to invest here in the region."(article source:automotive news)