Supply chain issues, record-high vehicle prices and remote work environments made vehicle problems surge to a record high this year, up 11% from a year earlier, according to J.D. Power's 2022 U.S. Initial Quality Study. GM was an outlier, with a broad increase in quality across its four brands.

Given the parts shortages and other disruptions automakers have coped with over the past year, the decline in quality could have been even steeper, J.D. Power says.

Pandemic-related disruptions have driven initial vehicle quality to the lowest point J.D. Power has recorded in 36 years.

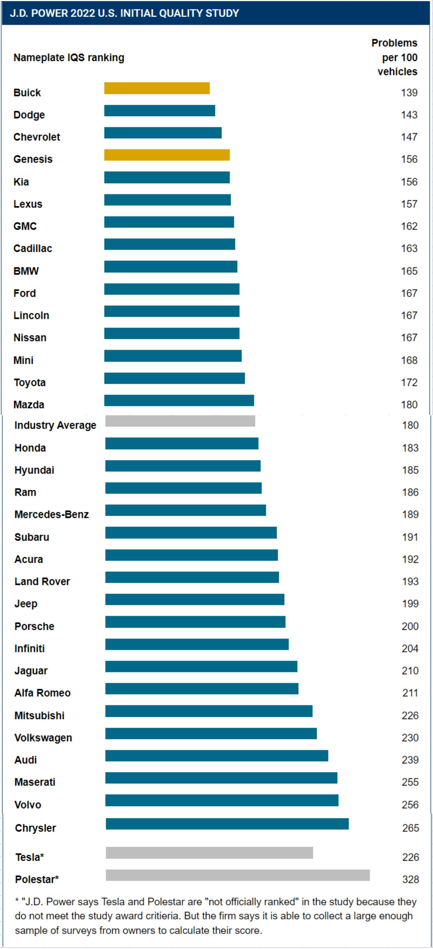

According to J.D. Power's 2022 U.S. Initial Quality Study, supply chain issues, record-high vehicle prices and remote work environments made vehicle problems surge to a record high this year, up 11 percent from a year earlier. On average, 180 problems per 100 vehicles were tracked industrywide, according to the report.

The study, fielded from February through May 2022, was based on responses from 84,165 car buyers and lessees of new 2022 model-year vehicles.

New-vehicle quality improved at just nine of 33 brands surveyed: Buick, Chevrolet, GMC, Cadillac, BMW, Mercedes-Benz, Acura, Land Rover and Audi.

David Amodeo, director of global automotive at J.D. Power, said the decline in quality could have been even steeper, given the parts shortages and other disruptions automakers have coped with over the past year.

"In general, initial quality has shown steady improvement throughout the history of this study, so the decline this year is disappointing — yet understandable," he said in a statement. "Automakers continue to launch vehicles that are more and more technologically complex in an era in which there have been many shortages of critical components to support them."

Many automakers have delivered vehicles to dealerships without certain features installed because of shortages of various parts, especially microchips.

"Communication with [customers] about the changes in feature availability, as well as when such features will be reinstated, is critical to their satisfaction," Amodeo said.

Mitsubishi's quality took the biggest hit compared with last year. The brand had 226 problems per 100 vehicles, up 82 from last year. Ram, which ranked No. 1 last year, had 186 problems per 100 vehicles, an increase of 58. Jeep, Volvo, Jaguar, Porsche and Hyundai also saw the number of problems per 100 vehicles rise by at least 36 over last year.

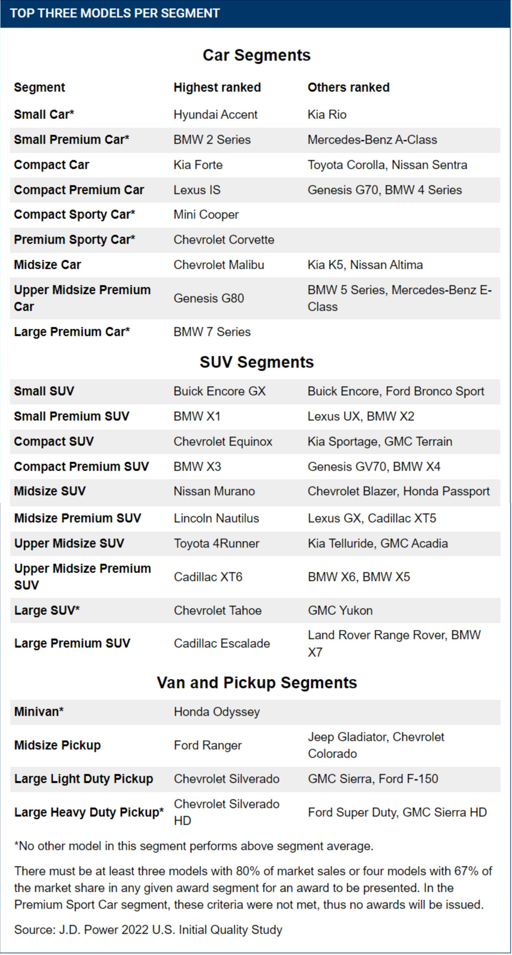

GM's wins General Motors was an outlier, with a broad increase in quality across its four brands, earning the highest ranking among automakers. Buick was the highest-ranking brand in the study, vaulting from 12th place in 2021. The Chevy Corvette was the highest initial quality model with 101 problems per 100 vehicles. GM earned the most model-level awards, followed by BMW.

Among premium brands, Genesis scored best and ranked No. 4 overall.

Tesla Motors was officially included in the industry calculation for the first time, with a score of 226 problems per 100 vehicles. Tesla does not allow J.D. Power access to owner information, making the automaker ineligible for awards and the brand ranking.

The most problems reported were tied to vehicles' infotainment systems, a trend from previous years' studies. Six of the top 10 problem areas were infotainment-related, such as Android Auto/Apple CarPlay connectivity, built-in voice recognition, difficulty with touch screens/display screens, built-in Bluetooth systems, too few power plugs/USB ports and inconsistent audio volume.

More problems were reported among battery-electric and plug-in hybrid vehicles than vehicles with internal-combustion engines. ICE vehicles averaged 175 problems per 100 vehicles, while plug-in hybrids averaged 226 problems, and battery-electric vehicles – excluding Tesla models—averaged 240.(article source:automotive news)